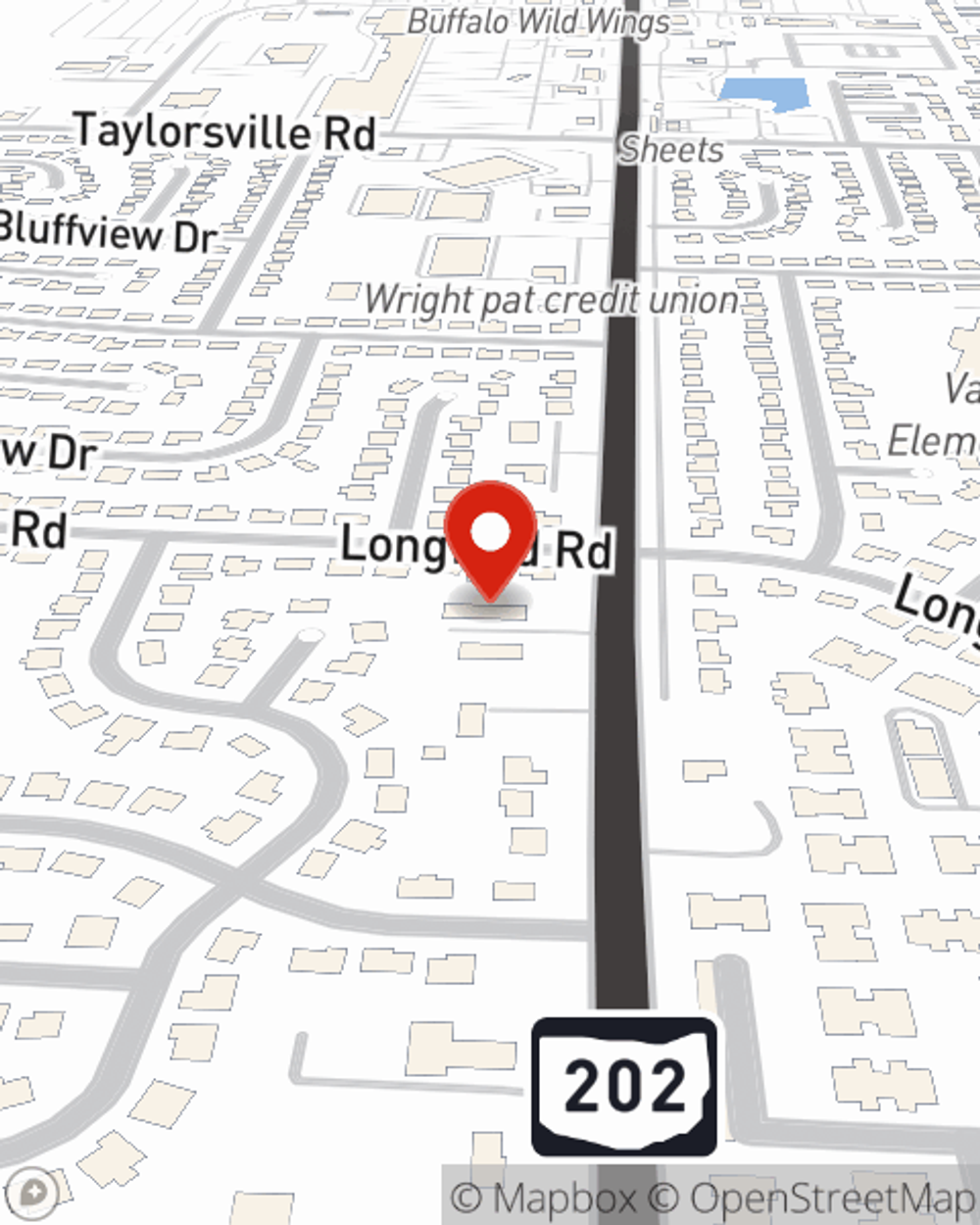

Homeowners Insurance in and around Huber Heights

Looking for homeowners insurance in Huber Heights?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories you hold dear. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get excellent homeowners insurance from State Farm.

Looking for homeowners insurance in Huber Heights?

The key to great homeowners insurance.

Homeowners Insurance You Can Trust

For insurance that can help insure both your home and your mementos, State Farm has options. Agent Nathan Baker's team is happy to help you generate a plan today!

Don't let your homeowners insurance go over your head, especially when the unforeseeable occurs. State Farm can bear the load of helping you get the home coverage you need. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Nathan Baker today for more information!

Have More Questions About Homeowners Insurance?

Call Nathan at (937) 236-9950 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

Nathan Baker

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.